Abstract

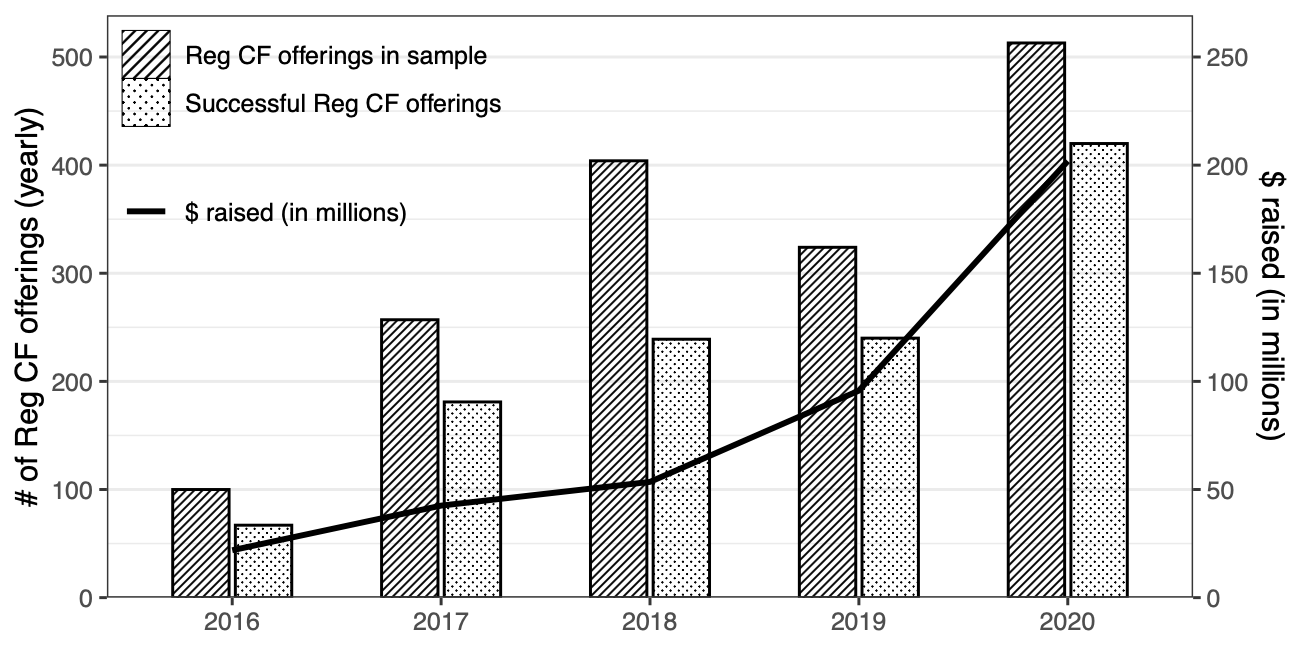

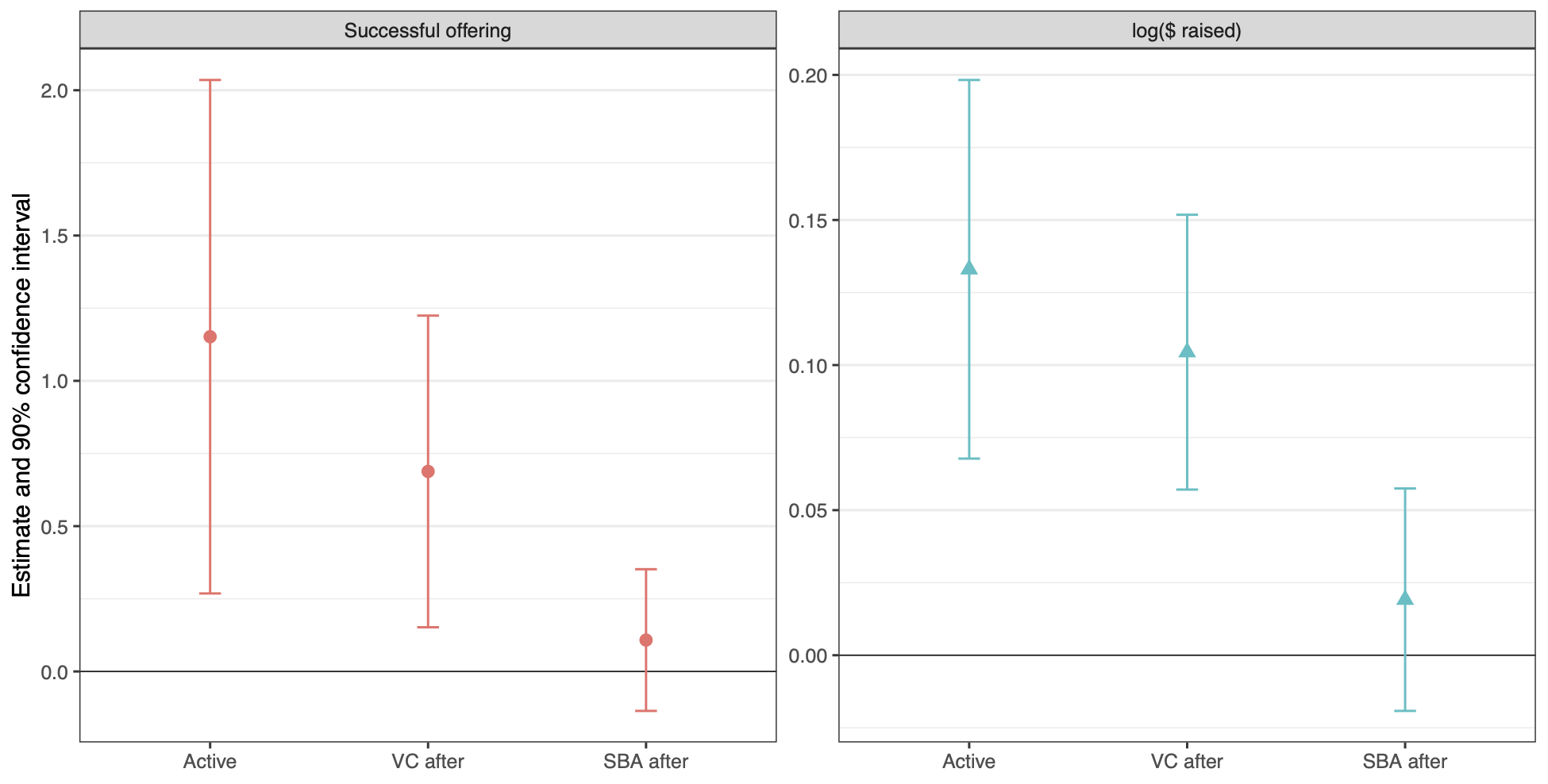

Equity crowdfunding allows small businesses to raise capital from the public via online platforms. We find that, despite having limited impact on diversifying entrepreneurship, it improves access to capital by financing younger firms compared to banks. Using the number of competing offerings as an instrument for equity crowdfunding success, we show that equity crowdfunding alleviates financial constraints of viable businesses. Successful issuers survive longer, are more likely to receive venture capital, and exhibit subsequent financial growth. We also find that equity crowdfunding activity is associated with both increased interest in entrepreneurship and increased venture capital investment in the local area.