Abstract

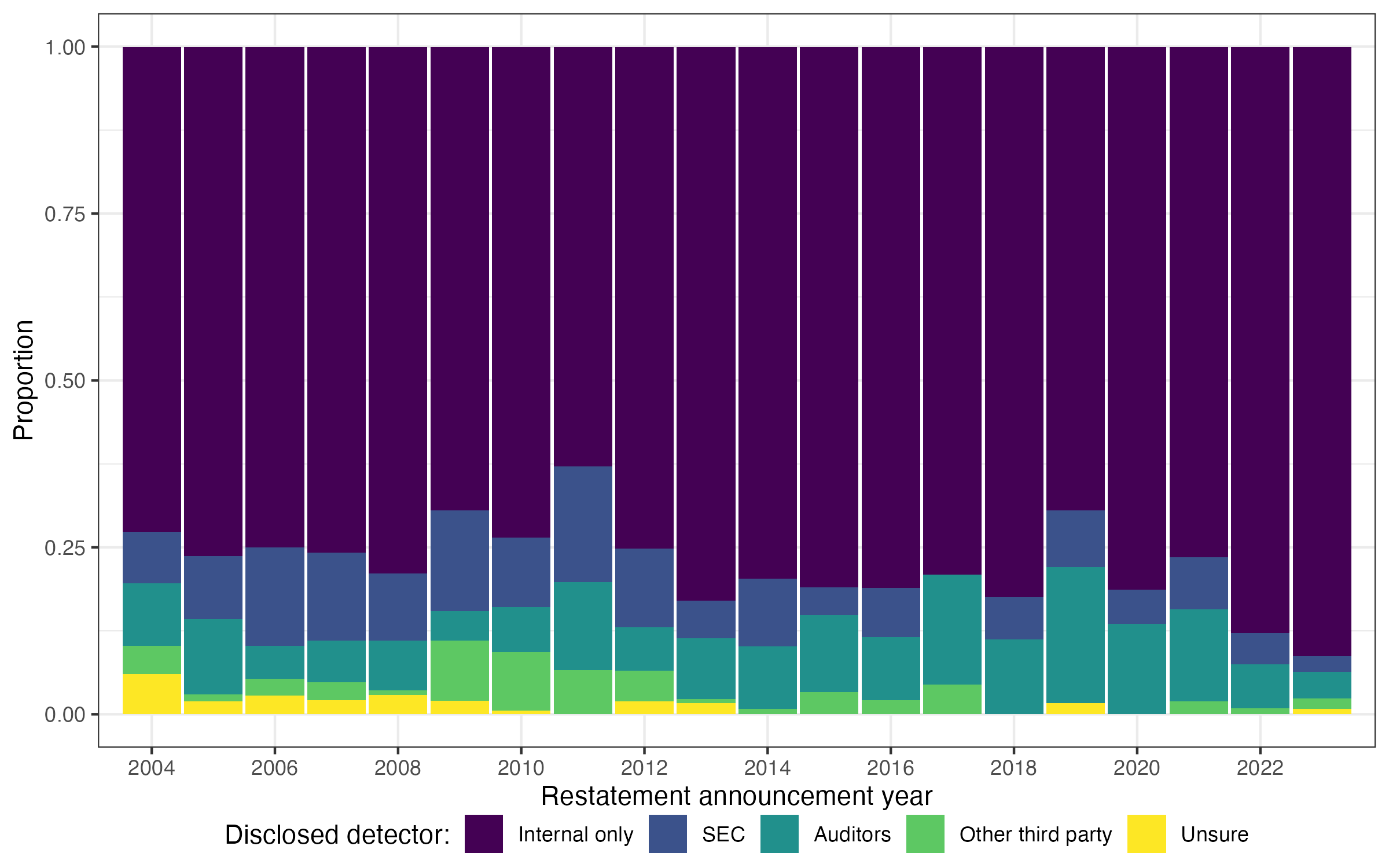

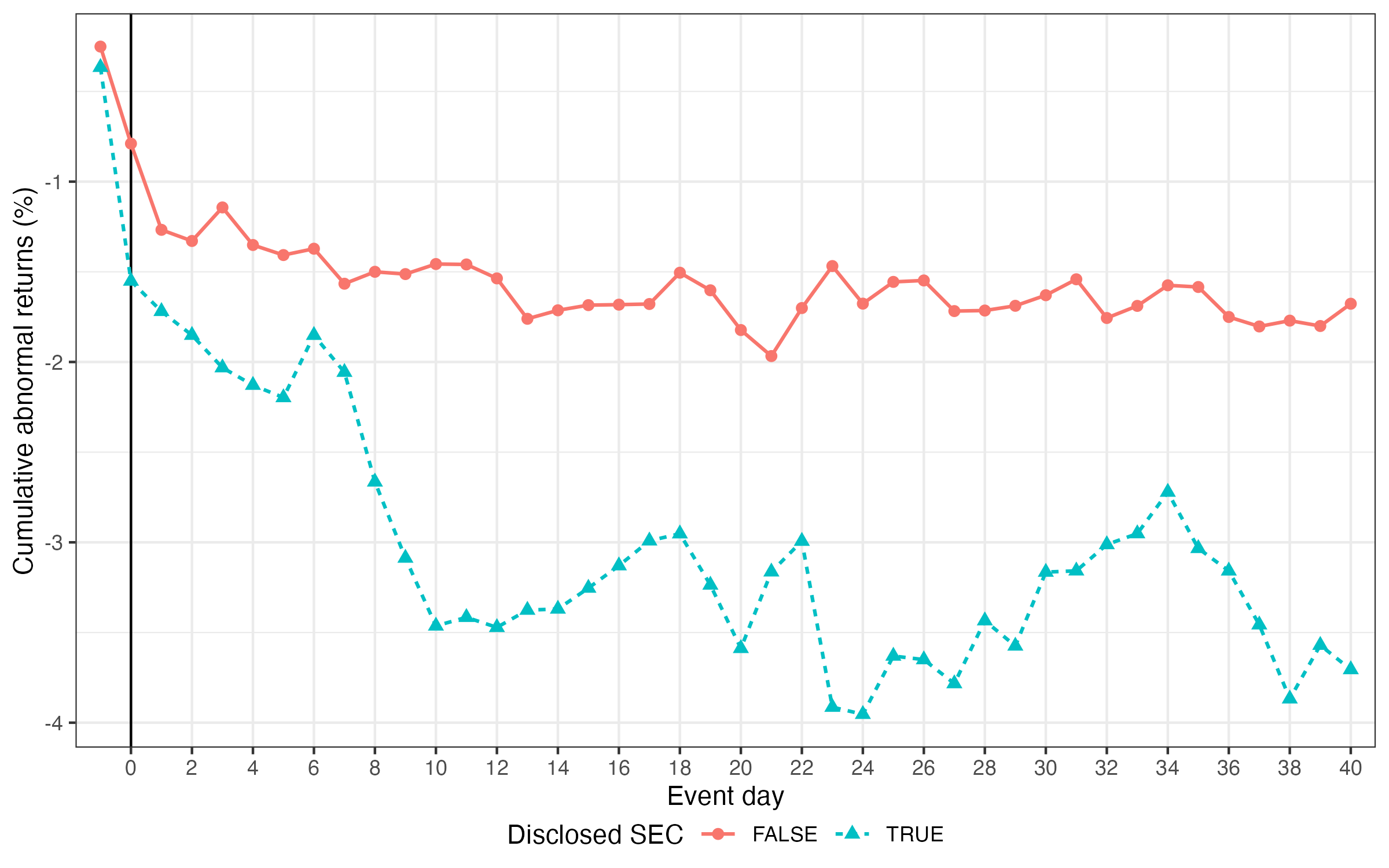

Big R restatements are significant corporate events, yet there is limited evidence on the roles of management, auditors, the SEC, and other third parties in detecting material misstatements. Similarly, little is known about how firms disclose these detectors. Using large language models and restatement announcements, we identify who firms credit for detecting material misstatements and contrast these disclosures with evidence from SEC comment letters and investigations. We document a large gap between disclosed and observed SEC detection. Consistent with a stylized model of the trade-offs between valuation and reputation consequences of this disclosure choice, firms that credit the SEC experience more negative market reactions but reduced executive turnover. We further show that managers are less forthcoming about SEC’s involvement when the SEC’s actions are less visible, and when their compensation is more sensitive to stock price.